FintechIO's Digital Innovation: Crafting a Mobile Banking Revolution for an Italian Bank

- Dan Vladoiu

- Jan 4, 2024

- 3 min read

Updated: Feb 27, 2024

Client Background:

Our client, a prominent Italian bank with a rich legacy in financial services, envisioned modernizing its offerings by introducing a state-of-the-art mobile banking application. With a focus on enhancing customer engagement and satisfaction, the client aimed to empower users to manage their current, savings, and investment accounts seamlessly on their mobile devices. Key objectives included delivering a cutting-edge UI/UX design, integrating with existing core banking systems, ensuring top-notch security, providing innovative investment insights, and ultimately, maximizing customer satisfaction.

Challenges:

Legacy Systems Integration: The primary challenge revolved around integrating the new mobile application with the bank's aging core banking systems, which operated on traditional architectures. Compatibility issues and data synchronization complexities needed to be addressed to ensure seamless functionality.

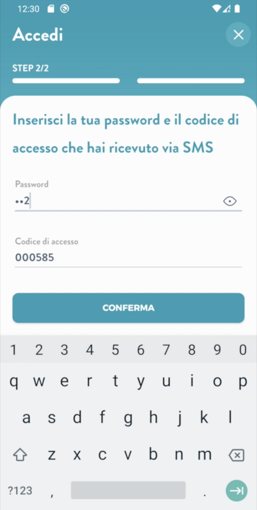

Security Concerns: Given the sensitivity of financial data, ensuring the highest level of security was paramount. The application required robust encryption methods, secure authentication mechanisms, and protection against threats such as data breaches and fraudulent activities.

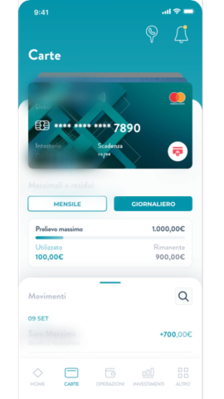

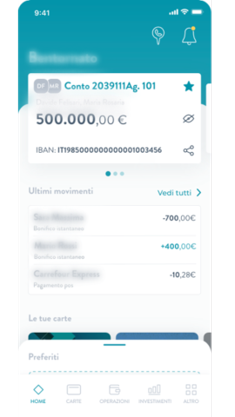

UI/UX Design: Crafting an intuitive and visually appealing interface was crucial for user adoption and engagement. The application needed to simplify complex banking processes, offer seamless navigation, and provide a consistent experience across various devices and screen sizes.

Innovation and Investment Insights: The client sought to differentiate its mobile banking experience by offering innovative features such as personalized investment insights. This included real-time market updates, portfolio tracking, and tailored recommendations to help users make informed investment decisions.

Solution:

Comprehensive Integration: Leveraging advanced API-based integration techniques, we seamlessly connected the new mobile application with the bank's legacy core banking systems. This facilitated real-time data exchange, enabling users to access accurate account information and conduct transactions without delays.

Robust Security Measures: Implementing industry-leading security protocols, including end-to-end encryption, multi-factor authentication, and biometric login options, ensured the protection of sensitive user data. Continuous monitoring and regular security updates were enforced to mitigate emerging threats effectively.

Intuitive UI/UX Design: Our design team meticulously crafted a modern and intuitive interface, focusing on clarity, simplicity, and accessibility. Through iterative design iterations and user testing, we optimized the layout, typography, and visual elements to deliver a seamless banking experience that resonated with Italian users.

Innovation and Investment Insights: The mobile banking application introduced innovative features tailored to meet the needs of investors, including:

Real-time Market Updates: Users could stay informed about the latest market trends, stock prices, and economic news, empowering them to make timely investment decisions.

Portfolio Tracking: Interactive charts and graphs allowed users to monitor their investment portfolios in real-time, track performance metrics, and analyze asset allocations.

Personalized Recommendations: Utilizing machine learning algorithms, the application provided personalized investment recommendations based on user preferences, risk tolerance, and financial goals.

Results:

Enhanced Customer Satisfaction: The mobile banking application received rave reviews from users, resulting in significantly improved customer satisfaction scores and retention rates. Users appreciated the convenience of managing their financial portfolios seamlessly on their mobile devices.

Streamlined Operations: By integrating with existing core banking systems, the application contributed to streamlined operations and improved efficiency for the bank. Automated processes and real-time data synchronization minimized errors and manual interventions, leading to cost savings and enhanced productivity.

Increased Engagement: The innovative investment insights and personalized recommendations offered by the application attracted users' interest and engagement. Users spent more time exploring investment opportunities and interacting with the platform, leading to deeper relationships with the bank.

Trusted Security: The robust security measures implemented in the application instilled confidence among users regarding the safety of their financial data. Compliance with regulatory standards and regular security audits reinforced trust and credibility in the banking institution.

Conclusion:

Through a strategic blend of advanced technology, user-centric design, and a relentless focus on security and innovation, we successfully delivered a mobile banking application that transformed the way users manage their current, savings, and investment accounts. By addressing integration challenges, prioritizing security, providing personalized investment insights, and maximizing customer satisfaction, we helped our client stay ahead in the competitive banking landscape, setting new benchmarks for digital banking excellence in Italy.

Comments